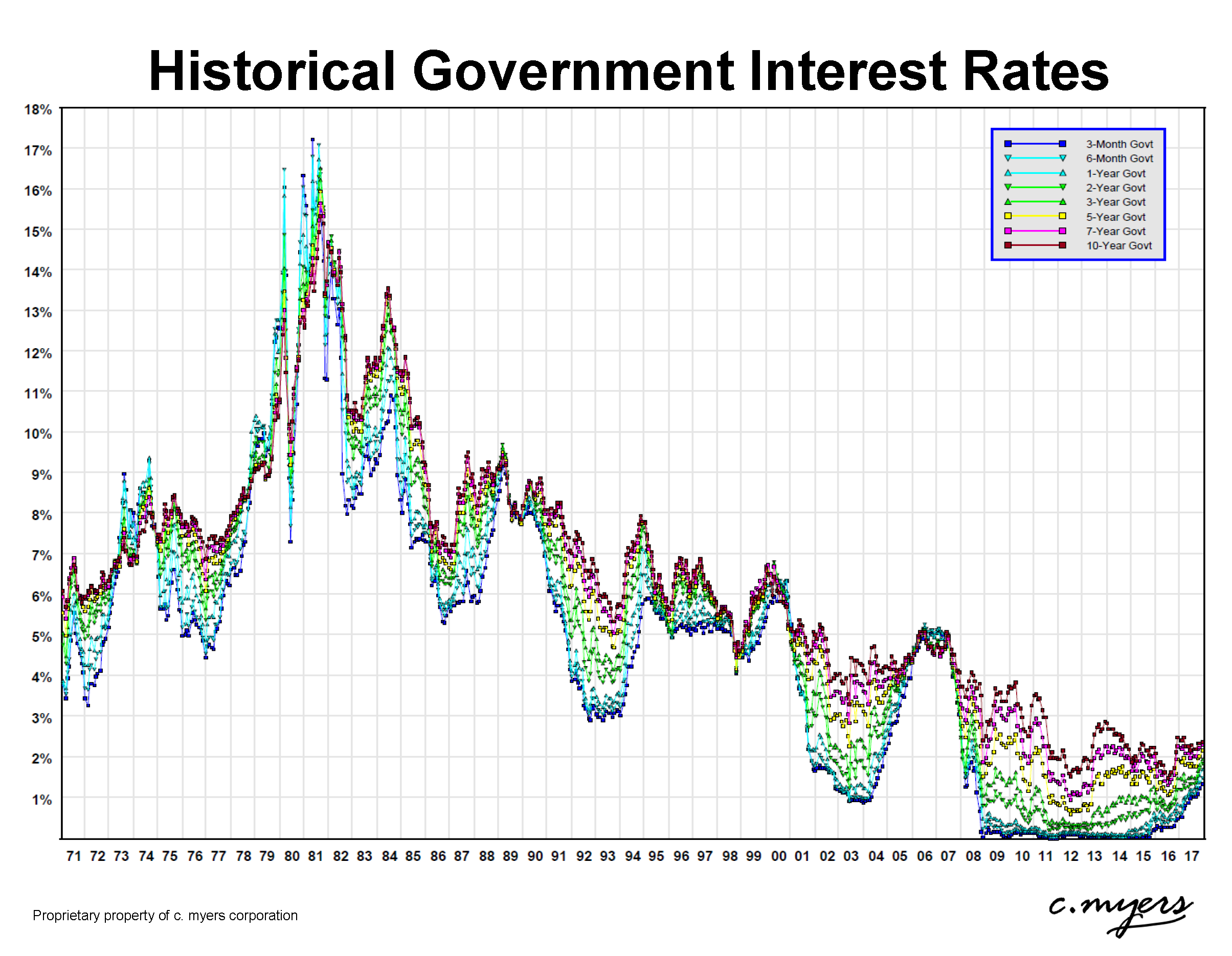

Webjul 29, 2020 · the business interest expense deduction limitation does not apply to certain small businesses whose gross receipts are $26 million or less, electing real property. Webfor taxable years beginning after december 31, 2017, the limitation applies to all taxpayers who have business interest expense, other than certain small businesses that meet the. Websep 1, 2019 · for tax years beginning after 2017, the deduction for business interest expense cannot exceed the sum of the taxpayer's: Floor plan financing interest expense.

Recent Post

- Caddo Sheriff Inmates

- Ups Store Laminating

- Mt Bank Treasury Center

- Fssa In Gov Benefits

- Deep Sleep Healing Music Youtube

- Mid Fade Fluffy Hair

- Salon Jobs Near Me

- Lyft Express Drive Application

- Sticks Larkin New Show

- Access To Large Orders Doordash

- Federal Express Drop Off Locations

- Target Careers Near Me

- Closest Ups Office To Me

- Anking V12 Media

- Nearest Ups Office

Trending Keywords

Recent Search

- Tri Cities Wa Death Notices

- Petsmart Jobs Part Time

- Texas Dept Of Justice Inmate Search

- Aig Layoff

- Lowes Wood Entry Doors

- Entry Level Writing Jobs Nyc

- Kroger Online Grocery Pickup Clerk

- Gang Sign

- Free Happy Birthday Meme

- Barney And Friends Waiting For Santa

- Jesus Calling Dec 18

- You Tube Newsmax

- Best Weapon In Blox Fruits

- Inspirational Memes For Work

- Garland County Mugshots Sentinel Record

![How To Write A Letter Of Interest In 2021 [Examples + Template] | Steve How To Write A Letter Of Interest In 2021 [Examples + Template] | Steve](https://blog.hubspot.com/hs-fs/hubfs/Sample Letter of Interest Example.png?width=2318&name=Sample Letter of Interest Example.png)